UIC on the Newspapers: Tarek A. Hayel Interview with Yemen Post Newspaper

“The problem we face today in Yemen is that people do not know the importance of insurance. Also, the government does not require people and authorities to have insurance. To add to that, the bad financial situation in the country makes people believe that they cannot afford insurance. Even through all these obstales, the number of those insured continue to grow everyday.”

Interviewed By: Hakim Almasmari ( YEMEN POST STAFF )

Article Date: July 07, 2008

YEMEN POST: What are the biggest obstacles facing insurance companies in Yemen?

Tariq Abdul Wase: In reality, we suffer from many problems. There are currently 13 insurance companies in Yemen. The problem we face today in Yemen is that people do not know the importance of insurance. Also, the government does not require people and authorities to have insurance. To add to that, the bad financial situation in the country makes people believe that they cannot afford insurance. Even through all these obstacles, the number of those insured continue to grow everyday.

YP: Why don’t insurance companies educate people about the importance of insurance and how they can benefit from it?

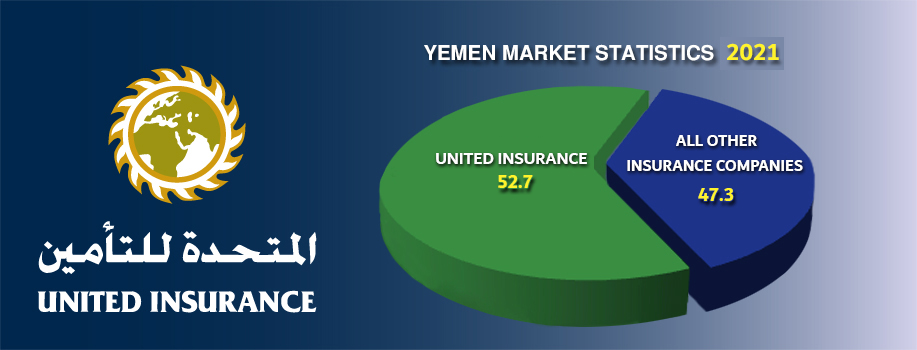

TA: I agree with you that there are not enough awareness campaigns from insurance companies. We as United Insurance, and as the biggest insurance company in Yemen do have awareness campaigns from time to time, but as the proverb says "One hand can’t clap". In addition to that, we have a lot of advertising ideas but we couldn’t find an advertising company in Yemen which is specialized in insurance matters.

YP: What about having awareness campaigns through television?

TA: Unfortunately, almost all people in Yemen don’t watch Yemeni channels on TV. Therefore, TV wouldn’t be helpful. Even if rural areas, people have switched to satellite channels and ignored the local Yemeni channel.

YP: Do you have any statistics showing the percentage of Yemeni people who have insurance?

TA: We don’t have any statistics showing the percentage of people who have insurance, but soon we will have statistics about the insurance market in Yemen. The statistics would show complete information for each insurance company and give more details about the companies’ activities, the kind of insurance they offer and also the compensation they offer citizens.

YP: Can you give an estimation of the amount of people who are ensured in Yemen?

TA: As an estimation, 5% would be logical.

YP: What are the most popular kind of insurance used in Yemen?

TA: The most common insurances in Yemen are car insurance, sea insurance, and fire insurance, among others.

YP: Yemeni people are poor, so how do you expect them to have life insurance or insurance for their property, when they don’t have enough money for essential needs?

TA: Yes, Yemeni people are poor but insurance is not costly. Most people think it is expensive, but the fact is the opposite. It might be costly if a person wants to have the complete insurance package for his car. If a person had an accident and killed 7 people, then he will have to pay 1,600,000 YR as compensation for each person. So, it is a strategy to be safe in case things happen, which in our country such problems always happen.

YP: Why do you think most people in Yemen don’t trust Yemeni insurance companies?

TA: It might be true that a lot of people here don’t trust Yemeni insurance companies, but I want to explain that not all insurance companies in Yemen are the same. There are excellent insurance companies as well as there are average and bad companies too. People should make sure that they choose the good company which they trust would pay them compensations if something happens to their insured property.

YP: What is the amount of compensations that United Insurance has paid to people since its establishment?

TA: United Insurance has compensated its customers more than $50 million dollars. In today's Yemeni Rials, it would be estimated at 50 Billion YR.

YP: Why are there no laws to secure people's rights from their insurance companies?

TA: There are laws but unfortunately weak. That is why we try to offer our customers services that benefit them, even if the law does not require us to do so. We offer them services that can guarantee their rights.

YP: People say that United Insurance is only successful because most of its insured customers belong to the Hayel Saeed Group, which also happens to owns United Insurance. Is that true?

TA: That saying was true when we started in the early 80's, and continued so in the 90's. However, we have achieved great success and most of our customers are not part of the Hayel Saeed Group. Today around 75% of our customers are from outside the Hayel Saeed Group.

YP: Why do most companies in Yemen prefer insurance companies outside Yemen, especially petroleum companies, and avoid local insurance companies?

TA: Unfortunately, we have been suffering from this for a long time. There is no specific reason for that but it happens as a result of weak Yemeni laws. Companies inside Yemen have foreign insurance companies, whereas by law they are supposed to be insured by an insurance company inside Yemen. If these companies were forced by law to pay to local insurance companies, than those companies would pay taxes to the government and it would also increase its employees; therefore, the government would benefit more.

YP: Why hasn't the government forced oil companies by law to have contracts with local insurance companies?

TA: Unfortunately, even though there are laws but there is no support from the government. It all goes back to not practicing the law.

YP: Most people in Yemen don’t trust the local health services so how could insurance companies convince people to have health insurance?

TA: That was in the past. Lately, the situation has changed to the better. Now we have good hospitals and we in United Insurance deal with the best hospitals in the country. We do not take our customers to normal hospitals.

YP: Can you name me a couple of those hospitals?

TA: For example in the capital, we deal with the Saudi German Hospital, and the Science and Technology Hospital among others. We always try to choose the best hospitals in each city for our customers.

YP: Insurance companies are suspected for making insurance easy for locals to get, but when it comes to compensating customers, they give them a headache before and rarely pay them their rights?

TA: That happens in some companies but not all insurance companies are the same. And as I mentioned earlier, the person who wants insurance shouldn’t seek the cheapest price only. He should also consider the reputation of the insurance company and the quality of service they offer. For example, in our company, we have customer care service and we care about the customer not differentiating whether he is from the higher of lower class in society. When it comes to helping them they are all the same. All get quality standard services.

YP: In 2007, United Insurance announced that more than 10,000 teachers joined its insurance system. Have the number of teachers increased from last year?

TA: To be honest with you, we have seen tremendous growth and the number continues to grow everyday.

YP: Blood money for a man is double of that for a woman by Yemeni law, does your company differentiate between them when it comes to compensation?

TA: By law, if another by accident, the blood money for a man is YR 1,600,000 and for a woman it is half of that, which equals YR 800,000. However, at United Insurance we do not differentiate, and we willingly give the same blood money to women and men. It is not fair to give women less when all are human.

YP: Do you have any final comments?

TA: I can say that in United Insurance, we offer insurance as a service and not as a profit and this is what makes us different than others. Thank you.

http://www.yemenpost.net/37/InvestigationAndInterview/20081.htm