UIC: Preserving its leadership in Yemen

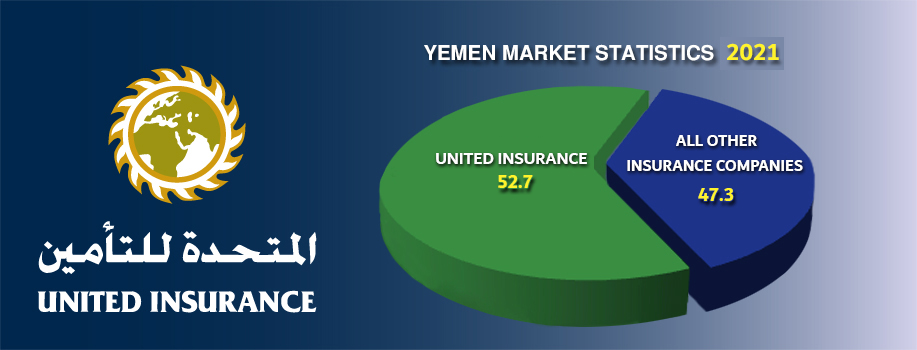

Despite severe competition, United Insurance Co (uic) has managed to maintain its leadership in Yemen’s insurance sector. Mr Tarek A Hayel Saeed, General Manager and Board Member

MiddleEast Insurance Review Magazine (MIR)

, gives an update on the company’s takaful unit.

Despite severe competition, United Insurance Co (uic) has managed to maintain its leadership in Yemen’s insurance sector. Mr Tarek A Hayel Saeed, General Manager and Board Member, gives an update on the company’s takaful unit – the country’s first – and explains why there is no more room for newcomers in the industry.

In the first three quarters of 2009, uic managed to generate the same amount of premium income for the corresponding period in the previous year. “I expect to maintain our market leadership, but it is unlikely for the whole market to see notable growth in 2009 compared to the 17% growth rate achieved in 2008,” said Mr Saeed.

In 2008, Yemen’s insurance market achieved YER14.4 billion (US$70 million) compared to YER12.5 billion in previous year. “This is partly because in 2009, there was greater pressure on prices which are already below the technical standards. Lines like fire, marine, motor, and construction saw a serious drop in prices with some declining over 50%. Besides price competition, the decrease in international prices for certain commodities like wheat, iron, and other material, have affected sizes of the sum insured for the industry.”

In 2008, uic had a GWP of YER6.3 billion against YER5.1 billion in the previous year, preserving its 42% market share. As part of the Hayel Saeed Group which has a wide network of commercial activities in Yemen and elsewhere in the region, the company is a leader in major segments such as fire and marine where it controls 54% of the market, as well as life (49%). For 2009, Mr Saeed expected uic to achieve a minimum of YER6.6 billion.

The takaful experience

One year after opening uic’s takaful window, Mr Saeed said that the experience remains in its early stages with slow growth mainly due to the lack of awareness of insurance in general and takaful in particular. “The public is unfamiliar with takaful and therefore, we launched promotional campaigns recently through SMS to introduce the company under the slogan ‘The Islamic Takaful Insurance’. This was done to promote our Shariah compliance and attract more segments of the population.”

Another boost to the business was the moving of the Hayel Saeed Group, which contributes 34% of uic’s premiums, to become customers of the takaful unit. Some of uic’s clients have opted to do the same and transfer their accounts to the takaful unit.

“Though this could have decreased the size of the conventional portfolio, business will flow into the same group. Moreover, it was part of our intention when we launched the takaful unit to respond to the growing needs of our clients who demanded Islamic solutions,” he added, noting that since uic’s move, four other market players have applied to the Industry & Trade Ministry to open takaful units.

uic’s takaful unit keeps separate accounts with a designated Shariah board to ensure compliance with all Islamic principles.

Lobbying for motor TPL

In the last few years, uic, together with other market players, has been actively urging the government to increase its support and give greater attention to the insurance sector. A major breakthrough is that the Ministry of Industry & Trade is presently looking at applying compulsory motor TPL for bodily injuries for passengers. The Yemeni market is one of the few MENA markets that does not apply this system and players have not been complaining due to the lack of the necessary infrastructure to adopt such a scheme. “This is the first step towards applying other covers for bodily injuries and material damages, when the proper conditions are created,” said Mr Saeed.

He added that prices are planned to be made affordable to citizens while insurers will be able to write safely in this line. “Presently, we are in the process of setting the suitable tariff in coordination with the Public Department of Traffic, Ministry of Interior, and the insurance companies. We expect the project to be launched by the middle of 2010.”

Insurers are still negotiating with the government to apply compulsory decennial liability insurance. “The Industry & Trade Ministry is not convinced as such a law is not applied in any of the neighbouring markets. Our argument is that awareness is higher in these countries and construction covers are more popular there. The Ministry prefers to work on providing advice to the construction companies and building owners to encourage them to take this kind of protection but leave it as a voluntary option.”

Nevertheless, Mr Saeed said that the government’s attention to the insurance sector has significantly improved in the last few years. “The new Oil Minister has shown greater interest in co-operating with players. I met with him early last year and convinced him to issue a new law requiring oil companies to tender for insurance covers from local insurance companies. This should curb the fronting phenomenon which is affecting the market. It will take time to fully control it but there is always a first step.”

No room for more entrants

It is not time for Yemen to accept new insurance companies, said Mr Saeed. “It will benefit neither the new investors nor the existing market players. This is mainly due to the business being highly concentrated among existing players and the small size of premiums. Hence, newcomers might resort to price cutting, further burdening to the sector. The Yemeni market is tough and price is the most significant factor in the selling process.”

Despite all the challenges, Mr Saeed is quite confident that uic will preserve its leading role as a genuine and reliable insurer continually responding to the market needs with the best possible means. In 2009, it raised its capital to YER1 billion to become the largest capitalised insurer in the market. The plan in 2010 is to establish a third party administrator together with one of the players to grow health insurance in a proper way.

ector. Mr Tarek A Hayel Saeed, General Manager and Board Member, gives an update on the company’s takaful unit – the country’s first – and explains why there is no more room for newcomers in the industry.

In the first three quarters of 2009, uic managed to generate the same amount of premium income for the corresponding period in the previous year. “I expect to maintain our market leadership, but it is unlikely for the whole market to see notable growth in 2009 compared to the 17% growth rate achieved in 2008,” said Mr Saeed.

In 2008, Yemen’s insurance market achieved YER14.4 billion (US$70 million) compared to YER12.5 billion in previous year. “This is partly because in 2009, there was greater pressure on prices which are already below the technical standards. Lines like fire, marine, motor, and construction saw a serious drop in prices with some declining over 50%. Besides price competition, the decrease in international prices for certain commodities like wheat, iron, and other material, have affected sizes of the sum insured for the industry.”

In 2008, uic had a GWP of YER6.3 billion against YER5.1 billion in the previous year, preserving its 42% market share. As part of the Hayel Saeed Group which has a wide network of commercial activities in Yemen and elsewhere in the region, the company is a leader in major segments such as fire and marine where it controls 54% of the market, as well as life (49%). For 2009, Mr Saeed expected uic to achieve a minimum of YER6.6 billion.

The takaful experience

One year after opening uic’s takaful window, Mr Saeed said that the experience remains in its early stages with slow growth mainly due to the lack of awareness of insurance in general and takaful in particular. “The public is unfamiliar with takaful and therefore, we launched promotional campaigns recently through SMS to introduce the company under the slogan ‘The Islamic Takaful Insurance’. This was done to promote our Shariah compliance and attract more segments of the population.”

Another boost to the business was the moving of the Hayel Saeed Group, which contributes 34% of uic’s premiums, to become customers of the takaful unit. Some of uic’s clients have opted to do the same and transfer their accounts to the takaful unit.

“Though this could have decreased the size of the conventional portfolio, business will flow into the same group. Moreover, it was part of our intention when we launched the takaful unit to respond to the growing needs of our clients who demanded Islamic solutions,” he added, noting that since uic’s move, four other market players have applied to the Industry & Trade Ministry to open takaful units.

uic’s takaful unit keeps separate accounts with a designated Shariah board to ensure compliance with all Islamic principles.

Lobbying for motor TPL

In the last few years, uic, together with other market players, has been actively urging the government to increase its support and give greater attention to the insurance sector. A major breakthrough is that the Ministry of Industry & Trade is presently looking at applying compulsory motor TPL for bodily injuries for passengers. The Yemeni market is one of the few MENA markets that does not apply this system and players have not been complaining due to the lack of the necessary infrastructure to adopt such a scheme. “This is the first step towards applying other covers for bodily injuries and material damages, when the proper conditions are created,” said Mr Saeed.

He added that prices are planned to be made affordable to citizens while insurers will be able to write safely in this line. “Presently, we are in the process of setting the suitable tariff in coordination with the Public Department of Traffic, Ministry of Interior, and the insurance companies. We expect the project to be launched by the middle of 2010.”

Insurers are still negotiating with the government to apply compulsory decennial liability insurance. “The Industry & Trade Ministry is not convinced as such a law is not applied in any of the neighbouring markets. Our argument is that awareness is higher in these countries and construction covers are more popular there. The Ministry prefers to work on providing advice to the construction companies and building owners to encourage them to take this kind of protection but leave it as a voluntary option.”

Nevertheless, Mr Saeed said that the government’s attention to the insurance sector has significantly improved in the last few years. “The new Oil Minister has shown greater interest in co-operating with players. I met with him early last year and convinced him to issue a new law requiring oil companies to tender for insurance covers from local insurance companies. This should curb the fronting phenomenon which is affecting the market. It will take time to fully control it but there is always a first step.”

No room for more entrants

It is not time for Yemen to accept new insurance companies, said Mr Saeed. “It will benefit neither the new investors nor the existing market players. This is mainly due to the business being highly concentrated among existing players and the small size of premiums. Hence, newcomers might resort to price cutting, further burdening to the sector. The Yemeni market is tough and price is the most significant factor in the selling process.”

Despite all the challenges, Mr Saeed is quite confident that uic will preserve its leading role as a genuine and reliable insurer continually responding to the market needs with the best possible means. In 2009, it raised its capital to YER1 billion to become the largest capitalised insurer in the market. The plan in 2010 is to establish a third party administrator together with one of the players to grow health insurance in a proper way.